What is NETELLER, and how does it work?

Buy Verified NETELLER Account is an online payment system known as an e-wallet, designed for secure and convenient digital transactions. Users can create a NETELLER account, link it to their bank accounts or credit cards, and store funds digitally. It functions as a bridge between traditional financial accounts and online purchases. With a NETELLER account, you can make online payments, transfer money to others via email, and even access a prepaid Mastercard for offline purchases and ATM withdrawals. It prioritizes security through encryption and two-factor authentication, making it a trusted choice for various online financial transactions.

How to create a NETELLER account?

Creating a NETELLER account is a straightforward process. Start by visiting the NETELLER website or mobile app. Click on the “Join for Free” or “Sign Up” button to begin the registration process. You’ll be asked to provide personal information such as your name, email address, and contact details. Additionally, you’ll need to set a secure password for your account. After completing the initial registration, you’ll be guided through a verification process, which may involve confirming your identity and linking a funding source, such as a bank account or credit card. Once verified, your NETELLER account on google is ready to use for online transactions and payments.

What are the benefits of using a NETELLER account?

Buy Verified NETELLER Account account offers several benefits. Firstly, it provides a secure and convenient way to make online payments and transactions. It also allows for easy money transfers to other NETELLER users. NETELLER’s prepaid Mastercard enables offline purchases and ATM withdrawals, adding to its versatility. Users can choose from multiple supported currencies, making it suitable for international transactions. Additionally, NETELLER offers a VIP program with various perks, such as lower fees and dedicated customer support, based on transaction activity. Overall, NETELLER simplifies online financial management and enhances the safety of digital transactions.

Are there any fees associated with a NETELLER account?

Yes, there are fees associated with using a NETELLER account. While creating an account is generally free, NETELLER charges fees for various services, including depositing funds, withdrawing money, currency conversion, and sending money to other NETELLER users. The specific fees can vary depending on your location, account type, and the payment method used. NETELLER may also have different fee structures for VIP members, offering reduced fees for higher-tier users. To understand the exact fees applicable to your transactions, it’s advisable to check NETELLER’s fee schedule on their website or within your account dashboard.

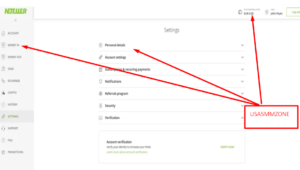

How can I verify my NETELLER account?

To verify your NETELLER account, follow these general steps:

1. Log In: Sign in to your NETELLER account using your username and password.

2. **Provide Personal Information**: Navigate to the verification section within your account settings. You will be asked to provide personal information, including your full name, date of birth, and residential address. Ensure that the information matches your identification documents.

3. **Identity Verification**: NETELLER may require you to verify your identity by uploading a copy of a government-issued ID, such as a passport, driver’s license, or national ID card. Make sure the document is clear and unexpired.

4. **Address Verification**: You might need to verify your address by uploading a utility bill, bank statement, or a similar document that shows your name and current residential address.

5. **Phone Verification**: NETELLER may also require phone verification. They will send a code to your registered phone number, which you will need to enter on the verification page.

6. **Submit Documents**: After providing the required information and documents, submit them through the NETELLER platform for review.

7. **Wait for Approval**: NETELLER will review your documents and information. The verification process typically takes a few business days. You will receive a notification once your account is successfully verified.

Completing the verification process is essential to unlock higher transaction limits and access certain features on your NETELLER account. Be sure to follow NETELLER’s specific instructions for verification, as they may have region-specific requirements or additional steps.

What types of transactions can I perform with a NETELLER account?

With a NETELLER account, you can perform various types of transactions:

1. **Online Shopping**: You can use your NETELLER account to make secure online purchases at websites and e-commerce platforms that accept NETELLER as a payment method.

2. **Money Transfers**: NETELLER allows you to send money to other NETELLER users by using their email addresses. This makes it easy to send funds to friends and family or pay for services.

3. **Withdrawals**: You can withdraw money from your NETELLER account to your linked bank account or another withdrawal option available in your region. This provides access to your funds when needed.

4. **Currency Conversion**: NETELLER supports multiple currencies, so you can perform currency conversions within your account to make international transactions more convenient.

5. **Prepaid Mastercard**: NETELLER offers a prepaid Mastercard that is linked to your account. You can use this card for online and offline purchases wherever Mastercard is accepted, as well as for ATM withdrawals.

6. **Online Gaming and Betting**: NETELLER is a popular choice for online gaming and betting, allowing users to deposit and withdraw funds from gaming and betting platforms.

7. **VIP Program**: Depending on your transaction activity and account history, you may qualify for NETELLER’s VIP program, which offers benefits like lower fees, higher transaction limits, and dedicated customer support.

These transaction options make NETELLER a versatile tool for managing your finances, both for everyday spending and for specific online activities like gaming and betting.

Is NETELLER a secure platform for online transactions?

Yes, NETELLER is considered a secure platform for online transactions. They prioritize user security through several measures, including data encryption to protect personal and financial information. They also offer two-factor authentication (2FA) for added account security. NETELLER complies with stringent industry regulations and employs fraud prevention mechanisms to safeguard against unauthorized access and fraudulent activities. Additionally, their dedicated customer support team is available 24/7 to assist users with any account-related concerns or issues, enhancing the overall safety of using the platform for online transactions.

Can I link my bank account or credit card to my NETELLER account?

Yes, you can link your bank account and credit card to your NETELLER account. NETELLER allows users to add funds to their account by linking it to their bank accounts or credit cards. This makes it convenient to deposit and withdraw money from your NETELLER wallet. Keep in mind that the availability of specific funding methods and the associated fees may vary depending on your location and NETELLER’s terms and conditions. Always verify the compatibility of your bank account or credit card with NETELLER and review any applicable fees before linking them to your account.

What are NETELLER’s currency conversion and exchange rate policies?

NETELLER provides currency conversion services for users who need to make transactions in different currencies. When you make a transaction involving currency conversion, NETELLER typically applies a foreign exchange fee and provides an exchange rate that may not be the same as the current market rate. The specific fees and rates can vary depending on factors like your account type, transaction volume, and the currencies involved. It’s important to review NETELLER’s fee schedule and exchange rate policies to understand the costs associated with currency conversion and make informed decisions when performing transactions in multiple currencies.

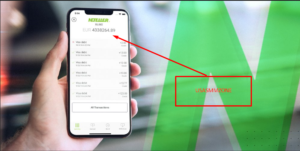

How do I deposit funds into my NETELLER account?

Depositing funds into your NETELLER account is straightforward. Here’s a general process:

1. **Log In**: Sign in to your NETELLER account using your username and password.

2. **Navigate to the Deposit Section**: Once logged in, locate the “Deposit” or “Money In” section within your account dashboard.

3. **Choose Funding Method**: Select the funding method you prefer, such as bank transfer, credit card, or another available option.

4. **Enter Amount**: Enter the amount you wish to deposit into your NETELLER account.

5. **Complete the Transaction**: Follow the prompts to complete the transaction. Depending on the funding method, you may need to provide additional information or verify your identity.

6. **Confirmation**: After the transaction is processed, you should receive a confirmation message, and the funds will be credited to your NETELLER account.

It’s important to note that NETELLER may have specific fees associated with different funding methods, and the availability of methods can vary depending on your location. Be sure to review NETELLER’s terms and conditions and fee schedule to understand the costs and options associated with depositing funds into your account.

Are there any restrictions on using NETELLER in certain countries?

Yes, there can be restrictions on using NETELLER in certain countries. NETELLER’s availability and services can vary by region due to regulatory and legal considerations. In some countries, NETELLER may be fully operational, offering a wide range of services, while in others, it may have limitations or even be unavailable. Additionally, certain high-risk industries like online gambling might face further restrictions in specific regions. To ensure NETELLER is available and compliant with local laws in your country, it’s essential to check NETELLER’s official website or contact their customer support for the most up-to-date information regarding service availability and any potential restrictions in your region.

What is the NETELLER VIP program, and how can I become a VIP member?

The NETELLER VIP program is designed to reward high-volume users with various benefits and privileges. To become a NETELLER VIP member, you typically need to meet specific transaction and deposit requirements, which can vary depending on your location and the program’s current criteria. Benefits of VIP membership may include lower fees, higher transaction limits, dedicated customer support, and access to additional features. NETELLER assesses your eligibility based on your transaction history and account activity. To become a VIP member, you should maintain a consistent transaction volume and adhere to NETELLER’s terms and conditions. NETELLER may periodically review your account to determine your VIP status.

What are the alternatives to NETELLER for online payments and transfers?

There are several alternatives to NETELLER for online payments and transfers, each with its own features and advantages. Some popular alternatives include:

1. **PayPal**: Widely used for online transactions and money transfers, PayPal offers a user-friendly interface and is accepted by many online merchants.

2. **Skrill**: Similar to NETELLER, Skrill is an e-wallet service that allows online payments, international transfers, and cryptocurrency transactions.

3. **Payoneer**: Payoneer specializes in cross-border payments and provides prepaid Mastercards for easy access to funds.

4. **Revolut**: A digital banking alternative, Revolut offers international currency exchange, spending analytics, and fee-free global spending.

5. **Stripe**: Ideal for businesses, Stripe provides a customizable payment processing platform for online stores and e-commerce.

6. **TransferWise (Wise)**: Known for low-cost international transfers, TransferWise offers transparent currency conversion rates and multi-currency accounts.

7. **Venmo**: Popular for peer-to-peer payments in the U.S., Venmo is owned by PayPal and allows easy money transfers between friends.

8. **Apple Pay and Google Pay**: Mobile payment solutions that enable in-store and online purchases through smartphones.

The choice of alternative depends on your specific needs, such as whether you require international transfers, e-commerce solutions, or peer-to-peer payment options. It’s essential to compare fees, features, and geographic availability to determine the best fit for your online financial activities.

Are there any notable security tips or best practices for NETELLER users?

Yes, here are some notable security tips and best practices for NETELLER users:

1. **Use Strong Passwords**: Create a strong, unique password for your NETELLER account and change it regularly.

2. **Enable Two-Factor Authentication (2FA)**: Activate 2FA to add an extra layer of security to your account.

3. **Beware of Phishing**: Be cautious of phishing emails or websites that mimic NETELLER. Always verify the authenticity of links and emails.

4. **Keep Software Updated**: Ensure your computer and mobile devices have up-to-date antivirus and security software.

5. **Monitor Account Activity**: Regularly review your transaction history for any unauthorized or suspicious activity.

6. **Secure Your Email**: Use a strong, unique password for your email account since it’s often used for account recovery.

7. **Use Official Channels**: Only download the official NETELLER mobile app from trusted app stores.

8. **Protect Personal Information**: Avoid sharing sensitive account information and never disclose your password or login details to anyone.

9. **Keep Contact Information Current**: Ensure NETELLER has your updated contact information for account recovery and security notifications.

10. **Educate Yourself**: Stay informed about the latest security threats and practices to protect your online financial assets effectively.

conclusion :

In conclusion, a NETELLER account is a versatile and secure digital payment solution that offers users the convenience of making online payments, transferring funds, and even accessing a prepaid Mastercard for offline purchases. It provides a bridge between traditional financial accounts and the online world, making it a valuable tool for individuals and businesses. However, users should be aware of the associated fees, currency conversion policies, and potential country-specific restrictions. By adhering to security best practices and staying informed about the latest features and updates, NETELLER users can enjoy a safe and efficient means of managing their online financial transactions.

Reviews

There are no reviews yet.